north carolina estate tax certification

The state adopted a flat income tax. Social Security is not taxed but other retirement income sources are fully taxed.

How To Avoid Estate Taxes With A Trust

This form should be completed if the North Carolina Decedent passed away on or after January 1 1999.

. Select your state from the list explore the available records and pick one in clicks. County Assessor and Appraiser Certification Table NCDOR. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE.

Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form. 28A-21-2a1 is not required for a decedent who died on or after 112013. Estate Tax Certification For.

Locate download and modify and eSign within minutes instead of days or weeks. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. Find a courthouse Find my court date Pay my citation online Prepare for jury service.

For a decedent who died before 111999 use AOC-E-207. This is a North Carolina form and can be use in Estate Statewide. An estate tax certification under GS.

IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. For a decedent who died before 111999 use AOC-E-207. Use this form for a decedent who died before 111999.

Raleigh North Carolina Estate Tax Certification - For Decedents Dying On Or After Finding a fillable document has never been so simple. Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399. The Property Tax Division of the North Carolina Department of Revenue is the division responsible for this administration.

The certification program shall be available to Tax Collectors Deputy Tax Collectors and Assistants support staff. Inheritance And Estate Tax Certification Form. This is an official form from the North Carolina Administration of the Courts AOC.

An estate tax certification under GS. Eligible - Has met NCDOR educational requirements for assessor and is qualified for the position but may or may not have been an assessor in the past. NA - Individual is a certified appraiser but is not eligible to be the assessor nor have they ever been a certified.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. At least 72 hours of CLE credits in estate planning and related fields. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

Inheritance And Estate Tax Certification. 28A-21-2a1 is not required for a decedent who died on or after 112013. Estate Tax Certification For Decedents Dying On Or After 1199.

Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property by taxing units throughout the State. This is a North Carolina form and can be use in Estate Statewide. North Carolinas income tax is a flat rate of 525.

Tax Collectors must meet the requirements as set forth in GS 105-349 of the Machinery Act. At least 45 hours shall be in estate planning and probate law provided however that eight of the 45 hours may be in the related areas of elder law Medicaid planning and guardianship. Use this form for a decedent who died on or after 111999 but prior to 112013.

Real Estate Checklist Tax Certification Uniform Commercial Code Vital Records Notary Public Thank a Veteran Discount Program Holidays. Home County Budget County Calendar. Walk-ins and appointment information.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Overall North Carolina Tax Picture. Inheritance And Estate Tax Certification PDF 245 KB.

Home County Budget County Calendar. Inheritance And Estate Tax Certification. USLF amends and updates the forms as is required by North Carolina statutes and law.

Requirements for Certification by the North Carolina Tax Collectors Association Revised May 9 2012 A. For a decedent who died before 111999 use AOC-E-207. North Carolina Judicial Branch Search Menu Search.

Division of Water Resources Tax Certification. Use this form for a decedent who died on or after 111999 but prior to 112013. Estate Tax Certification For Decedents Dying On Or After 1 1 99 Form.

Cary North Carolina Estate Tax Certification - For Decedents Dying On Or After Save your time and find the form or commitment youre searching for in US Legal Forms extensive a state-specific catalogue of more than 85k templates. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. Free Preview North Carolina Estate Tax.

This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes. Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE.

Appointments are recommended and walk-ins are first come first serve. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. 28A-21-2a1 is not required for a decedent who died on or after 112013.

Estate Tax Certification For Decedents Dying On Or After 1 1 99. The rate threshold is the point at which the marginal estate tax rate kicks in. To be a certified assessor the provisions of NCGS 105-294 must be met.

An estate tax certification under GS. Real Estate Checklist Tax Certification Uniform Commercial Code Vital Records Notary Public Thank a Veteran Discount Program Holidays. North Carolina is moderately tax-friendly for retirees.

28A-21-2a1 is not required for a decedent who died on or after 112013. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Download Or Email NC E-590 More Fillable Forms Register and Subscribe Now.

Use this form for a decedent who died on or after 111999 but prior to 112013. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. The balance may be in the related areas of taxation business organizations real.

For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. An estate tax certification under GS.

How To Avoid Estate Taxes With A Trust

North Carolina Birth Certificate Sample Fill Online Printable Fillable Blank Pdffiller

Forms Tax Department Tax Department North Carolina

How Long Does It Take To Probate A Will In Nc Teddy Meekins Talbert P L L C

What Is The Purpose And Benefit Of Authenticating Your Birth Certificate On The County State And Federal Level Quora

Nc Document Standards Minimum Standards For Indexing Real Property Instruments Register Of Deeds

Special Power Of Attorney Form Unique Limited Power Of Attorney Motor Vehicle Transactions Power Of Attorney Form Power Of Attorney Job Application Template

Whitfield Gibson In House Counsel Candlescience Linkedin

Jesse T Coyle Southern Pines Nc Estate Planning Probate Attorney

How To Avoid Estate Taxes With A Trust

Annuity Suitability Training Overview Best Interest Training Webce

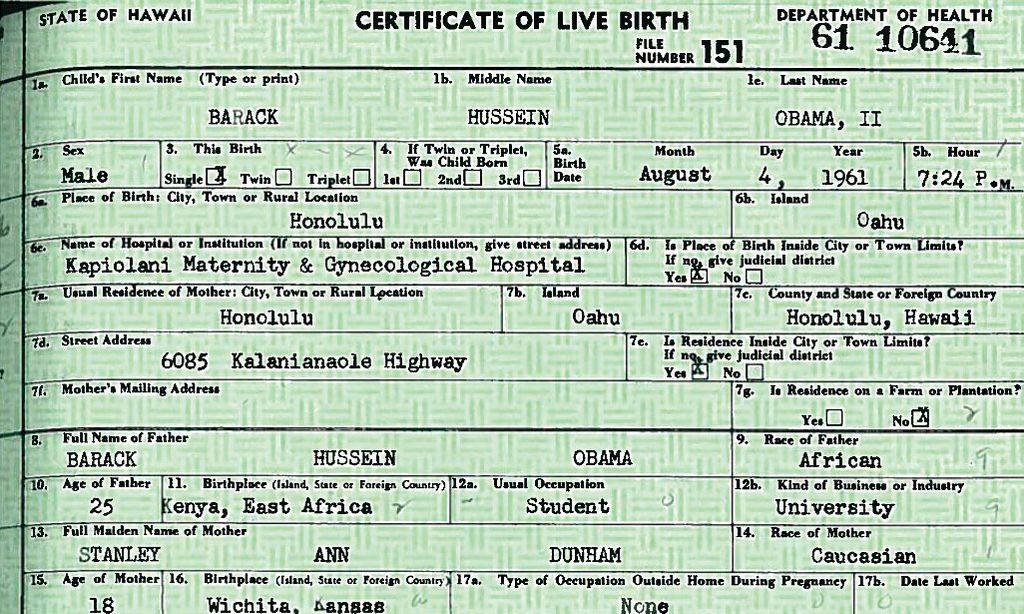

A History Of President Obama S 8 Years In Office

Code Of Ordinances Dare County Nc

/WeddingRingsandCash-bd38d7176517443ca9d6a66869d23b9a.jpg)

Marriage Vs Common Law Marriage What S The Difference